The administration justifies taking equity stakes in private industries—a form of state capitalism—by reframing the global landscape as an "economic war." The pandemic exposed critical supply chain vulnerabilities in areas like semiconductors and pharmaceuticals, making domestic production a matter of national security, similar to wartime industrial mobilization.

Related Insights

The post-1980s neoliberal consensus of small government and free trade is being replaced by a mercantilist approach. Governments, particularly the U.S., now actively intervene to protect domestic industries and secure geopolitical strength, treating trade as a zero-sum game. This represents a fundamental economic shift for investors.

The administration's explicit focus on re-shoring manufacturing and preparing for potential geopolitical conflict provides a clear investment playbook. Capital should flow towards commodities and companies critical to the military-industrial complex, such as producers of copper, steel, and rare earth metals.

By framing competition with China as an existential threat, tech leaders create urgency and justification for government intervention like subsidies or favorable trade policies. This transforms a commercial request for financial support into a matter of national security, making it more compelling for policymakers.

To counter the economic threat from China's state-directed capitalism, the U.S. is ironically being forced to adopt similar strategies. This involves greater government intervention in capital allocation and industrial policy, representing a convergence of economic models rather than a clear victory for free-market capitalism.

Modern global conflict is primarily economic, not kinetic. Nations now engage in strategic warfare through currency debasement, asset seizures, and manipulating capital flows. The objective is to inflict maximum financial damage on adversaries, making economic policy a primary weapon of war.

The U.S. is shifting from industry supporter to active owner by taking direct equity stakes in firms like Intel and U.S. Steel. This move blurs the lines between free markets and state control, risking a system where political connections, not performance, determine success.

A U.S. national security document's phrase, "the future belongs to makers," signals a significant policy shift. Credit and tax incentives will likely be redirected from financial engineering (e.g., leveraged buyouts in private equity) to tangible industrial production in order to build resilient, non-Chinese supply chains.

Historically, the U.S. government has only taken equity in private firms during bailouts with the goal of exiting quickly. Recent deals with companies like Intel represent a new strategy of long-term investment to bolster specific industries, a marked departure from past policy.

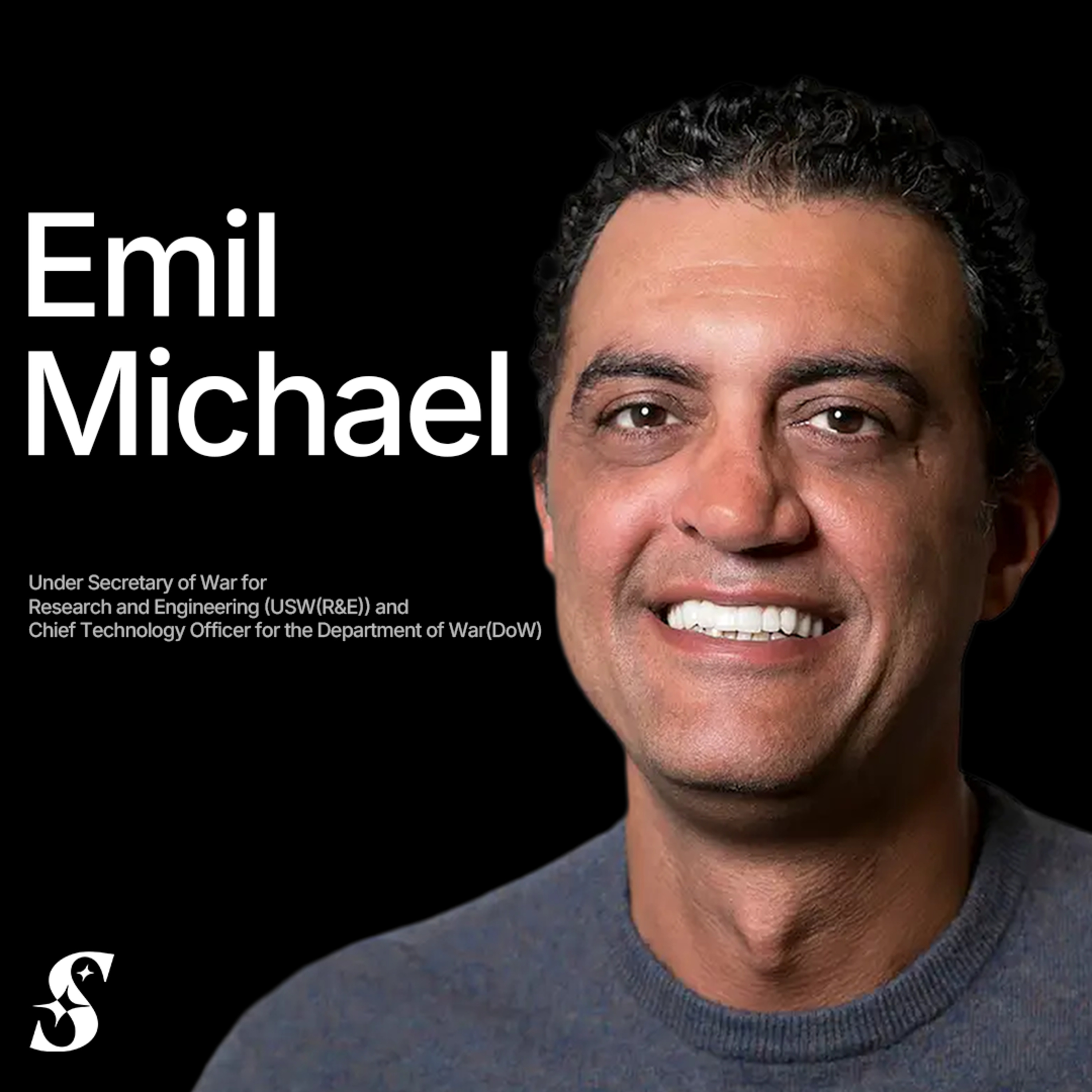

The Under Secretary of War defines the current "1938 moment" not as an imminent war, but as a critical juncture for rebuilding the domestic industrial base. The focus is on reversing decades of outsourcing critical components like minerals and pharmaceuticals, which created strategic vulnerabilities now deemed unacceptable for national security.

The government is no longer just a regulator but is becoming a financial partner and stakeholder in the tech industry. Actions like taking a cut of specific chip sales represent a major "fork in the road," indicating a new era of public-private relationships where government actively participates in financial outcomes.