While competitors faced government lawsuits, Circle remained unscathed by designing its business within existing legal frameworks for payment systems and electronic money. This proactive, compliance-first approach provided a defensive moat against the regulatory uncertainty that plagued the crypto industry.

Related Insights

Contrary to belief, the crypto industry's primary need is not deregulation but clear, predictable rules. The ambiguous "regulation through enforcement" approach, where rules are defined via prosecution, creates uncertainty that drives innovation and capital offshore.

Unlike competitors using crypto to operate outside regulatory frameworks, Kalshi's CEO views on-chain technology as a tool to enhance a regulated system. He envisions using it for clearing to improve immutability and transparency, enabling a permissionless ecosystem built upon a compliant foundation.

Kalshi spent years working with regulators before launching, while competitor Polymarket gained mindshare by operating in a legal gray area. This dynamic frustrated Kalshi, which felt it was carrying the burden of legalization while its rival scaled without the same restrictions, highlighting two opposing fintech philosophies.

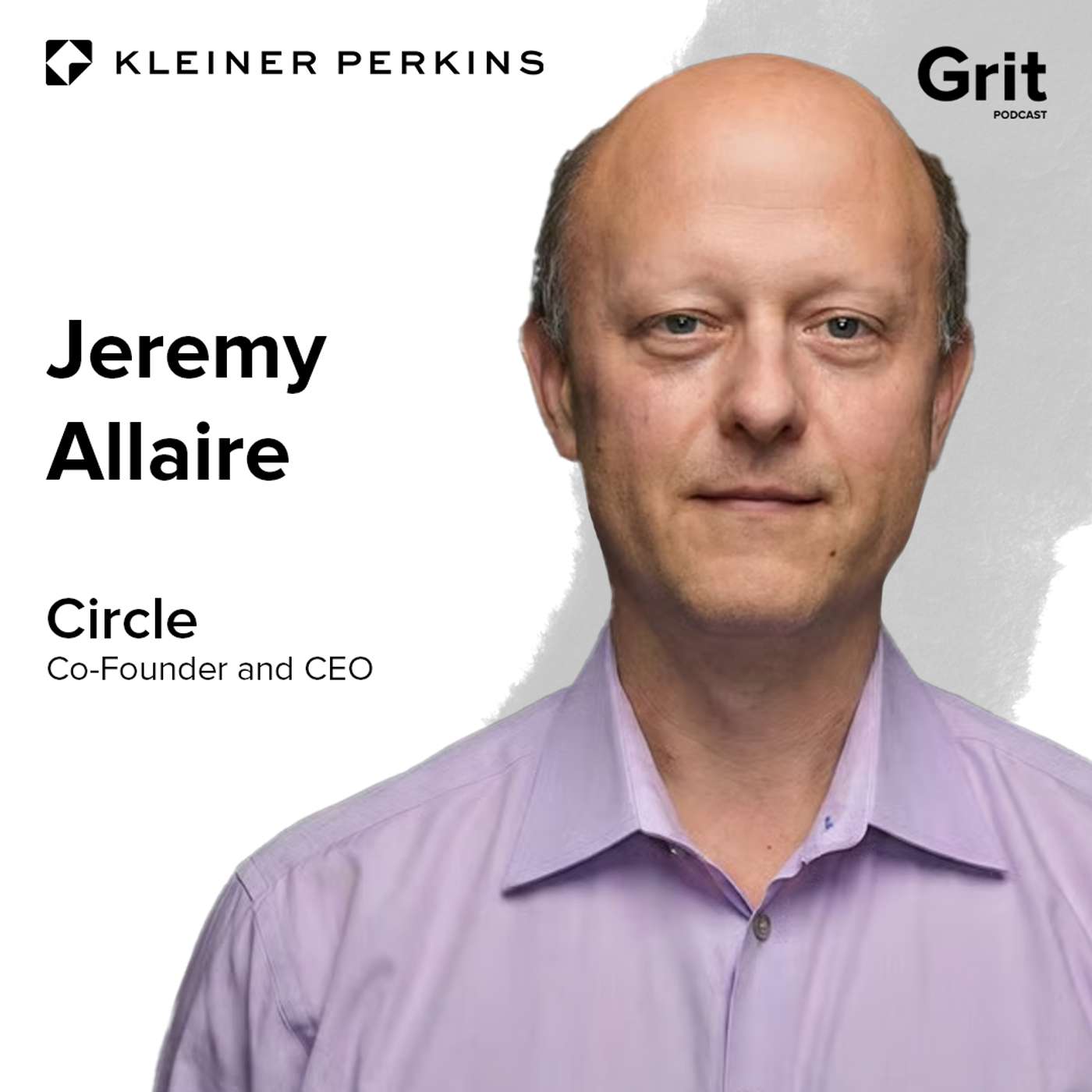

Circle's CEO chose to engage US regulators from the start in 2013, a harder path than competitors who went offshore. This "buttoned up" approach, while met with hate from crypto purists, established long-term trust and a competitive moat, which proved crucial for attracting institutional partners.

While the early crypto market was dominated by cypherpunks advocating for anonymity, Coinbase took the opposite approach. They worked with banks and implemented KYC, betting that mainstream adoption required a compliant, trusted platform, even though it alienated the initial user base.

Tarek Mansour views Kalshi's strict, federally regulated approach as a strategic advantage. It forces robust system pressure-testing and makes the platform an unattractive venue for fraud or insider trading, which naturally flows to unregulated, offshore alternatives.

While fast-moving, unregulated competitors like FTX garner hype, a deliberate, compliance-first approach builds a more resilient and defensible business in sectors like finance. This unsexy path is the key to building a lasting, mainstream company with a strong regulatory moat.

The stablecoin market isn't about everyone launching their own coin. Established players like Circle's USDC create powerful network effects through tens of thousands of API integrations with apps like Cash App and Coinbase. This utility makes it the default choice for developers, creating a significant competitive moat.

Unlike traditional banks that lend deposits multiple times, USDC is a 'full reserve' system. Every digital dollar is backed 1-to-1 by cash and short-term treasuries, eliminating lending risk. This 'narrow banking' model, now enshrined in law, offers a fundamentally safer financial instrument.

To avoid being classified as a bank, Coinbase's stablecoin model offers "rewards" for user activity like payments or trading, rather than paying interest directly on balances. This is a crucial legal distinction under new regulations allowing them to pass on yield from treasury reserves.