Jetpack company Gravity is commercializing its futuristic technology through practical, high-value niches. Instead of focusing on consumers, its go-to-market strategy targets defense applications, like boarding ships, and media opportunities. It also runs a training school to create a skilled pilot base for these operations.

Related Insights

After failing as a city-wide transit solution, the moving walkway found its perfect product-market fit in airports, solving the specific pain point of long treks through ever-expanding terminals created by the jet age.

Instead of building a consumer brand from scratch, a technologically innovative but unknown company can license its core tech to an established player. This go-to-market strategy leverages the partner's brand equity and distribution to reach customers faster and validate the technology without massive marketing spend.

Luckey reveals that Anduril prioritized institutional engagement over engineering in its early days, initially hiring more lawyers and lobbyists. The biggest challenge wasn't building the technology, but convincing the Department of Defense and political stakeholders to believe in a new procurement model, proving that shaping the system is a prerequisite for success.

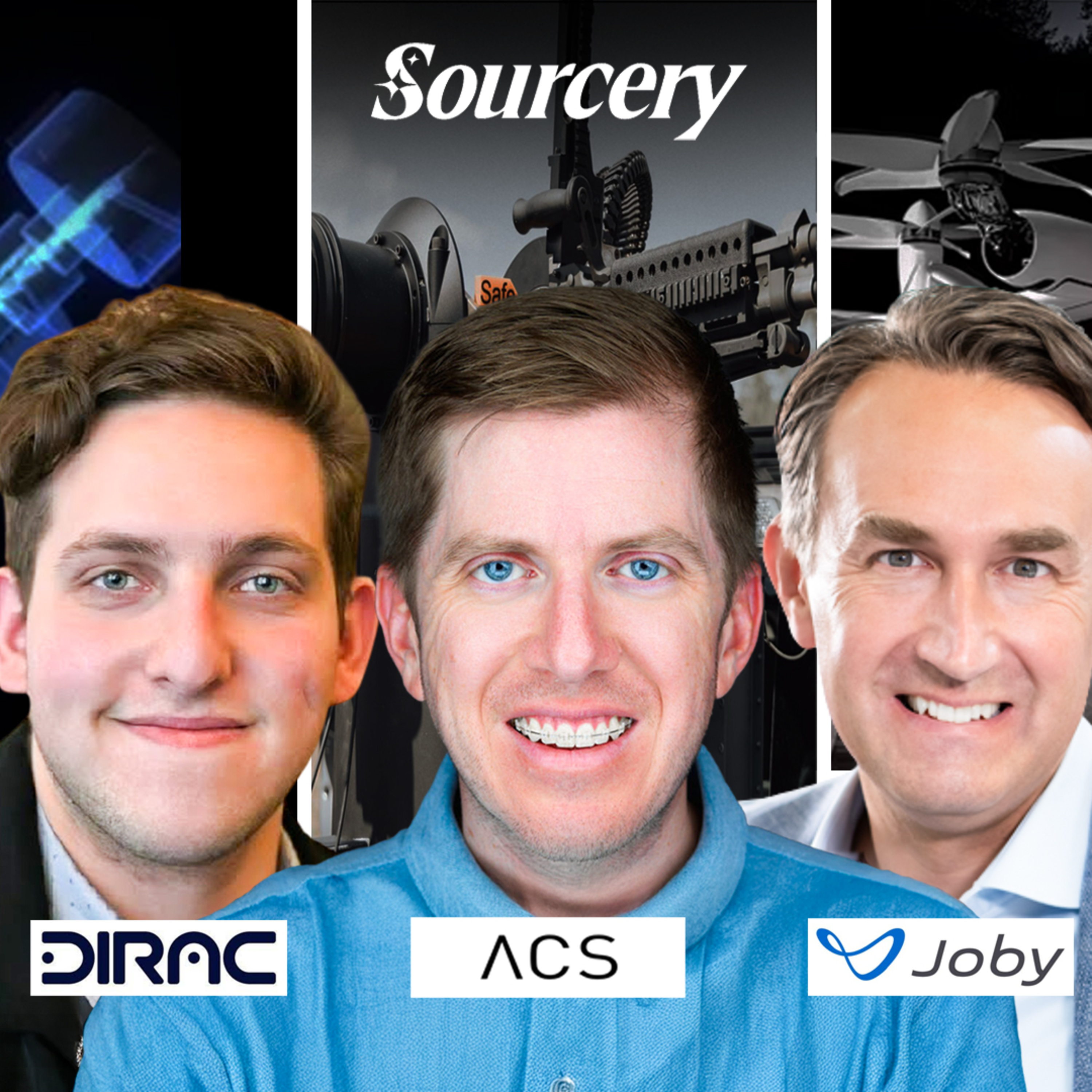

When asked how he recruits talent for a challenging hardware business, the founder of Allen Control Systems stated it's easy because 'We're making the greatest weapon system in American history.' This demonstrates that for deep tech and defense startups, a powerful and ambitious mission can be more effective than conventional recruiting strategies.

Tech companies often use government and military contracts as a proving ground to refine complex technologies. This gives military personnel early access to tools, like Palantir a decade ago, long before they become mainstream in the corporate world.

Many defense startups fail despite superior technology because the government isn't ready to purchase at scale. Anduril's success hinges on identifying when the customer is ready to adopt new capabilities within a 3-5 year window, making market timing its most critical decision factor.

Marketing a defense company is fundamentally different from marketing a consumer product. Instead of a broad "one-to-all" campaign targeting millions of customers, defense marketing is a "one-to-few," hyper-targeted effort aimed at a small group of influential government decision-makers who could all fit in a single conference room.

The venture capital mantra that "hardware is hard" is outdated for the American Dynamism category. Startups in this space mitigate risk by integrating off-the-shelf commodity hardware with sophisticated software. This avoids the high capital costs and unpredictable sales cycles of consumer electronics.

While pursuing a long-term research goal, the company's commercial strategy is to build AI co-pilots and intelligence layers for R&D workflows in established industries like space and defense. This approach productizes intermediate progress and targets massive existing R&D budgets.

The go-to-market strategy for defense startups has evolved. While the first wave (e.g., Anduril) had to compete directly with incumbents, the 'Defense 2.0' cohort can grow much faster. They act as suppliers and partners to legacy prime contractors, who are now actively seeking to integrate their advanced technology.

![Palmer Luckey - Inventing the Future of Defense - [Invest Like the Best, CLASSICS] thumbnail](https://megaphone.imgix.net/podcasts/f7c9aa8e-cb8d-11f0-828e-0b281809c10a/image/cc07f91ec47f95abbde771a4956b37b7.jpg?ixlib=rails-4.3.1&max-w=3000&max-h=3000&fit=crop&auto=format,compress)